Digital transformation and the rise of cloud services are driving demand for data center capacity to new heights. Hyperscale operators and consumer-oriented cloud providers continue to expand their operations aggressively.

According to Statista, in 2021, humanity created, copied, and consumed an estimated 79 zettabytes of data. To put that in perspective, it would take a million supercomputers to store just one zettabyte.

Keeping up with this tremendous spike in data usage, operators built or expanded over 515 facilities in 2021 alone. The Asia-Pacific region led the charge with 161, followed by Europe and North America.

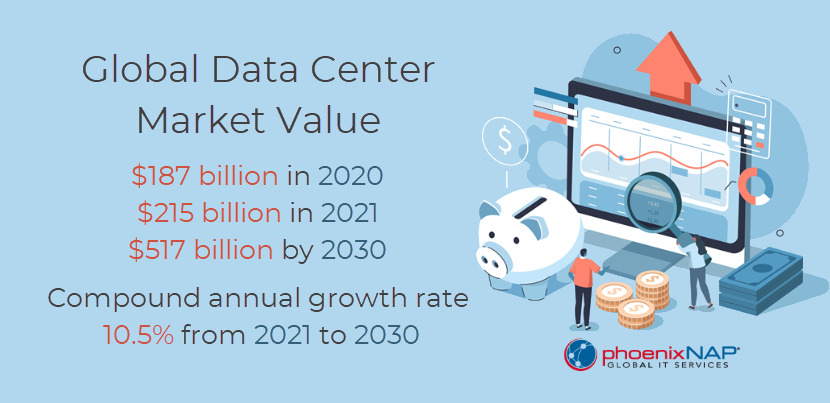

Global Data Center Market - Key Insights

In 2021, colocation operators accounted for approximately 55% of the total market investment. The industry also saw an increase in self-made hyperscale data centers. Heavyweights like Facebook, Google, Amazon, and Microsoft contributed roughly 35% of the total area expansion.

Main Drivers of Data Center Growth

Driven by increased demand, the data center industry is expanding. Key considerations include:

- The rise of remote work and learning.

- The development of data-hungry technologies, including IoT, Machine Learning, and AI.

- The digitization of business processes.

- The Industrial digital transformation.

- The rise in the number of small and medium enterprises adopting digital technology.

COVID-19 Impact on the Market

The pandemic has acted as an accelerator and compressed many years’ worth of change into months. It also highlighted that technology had entered practically every part of our lives, generating an ever-increasing amount of data.

Maintaining the access and reliability of online services while dealing with rising demand proved to be a challenging task. Data centers rose to the challenge, ensuring that companies remained functional and people’s daily lives were unaffected.

The pandemic also marked a watershed moment for the mass adoption of many advanced technologies. Cloud computing, AI, edge computing, Big Data, and 5G all experienced a massive kickstart during the pandemic.

Check out our post Edge Computing vs Cloud Computing to learn more about the differences between these two architectures.

Industries that Have Grown in Response to COVID-19

- Platforms for online communication. As people became physically isolated, tools like Zoom, Skype, FaceTime, Microsoft Teams, and Google Hangouts have connected people virtually.

- Cloud services. With the rise in popularity of remote work, cloud services have become an integral part of business infrastructure.

- Streaming services. With the stress and uncertainty surrounding health and safety, many have turned to music and movie streaming to unwind at the end of a long day.

Other Factors and Their Impact on the Market

There is a growing demand from the Asia-Pacific region, driving the market. According to the latest reports, the data center industry in the Asia Pacific region expanded by 24% in 2021. This demand for data has prompted China to approve the construction of ten data center clusters in strategic locations.

Similarly, there has been a 30% growth in the data center market in India since 2019. The subcontinent's digital economy contributes 9.5% of GDP. That figure includes 1.2 billion mobile phone subscriptions, indicating the massive scope of possible data center development in the future.

Another key factor to consider is the rapid digitalization of banking, financial services, and insurance companies around the world. As a leading data generator, they are becoming increasingly reliant on Big Data to perform everyday tasks.

Financial institutions use technology to curb operating costs, develop infrastructure, and generate critical insights about their customers. Many banks run their own data centers, but that trend is changing. Declining profits and expense drain mean financial services and banking firms are increasingly looking to outsource data services.

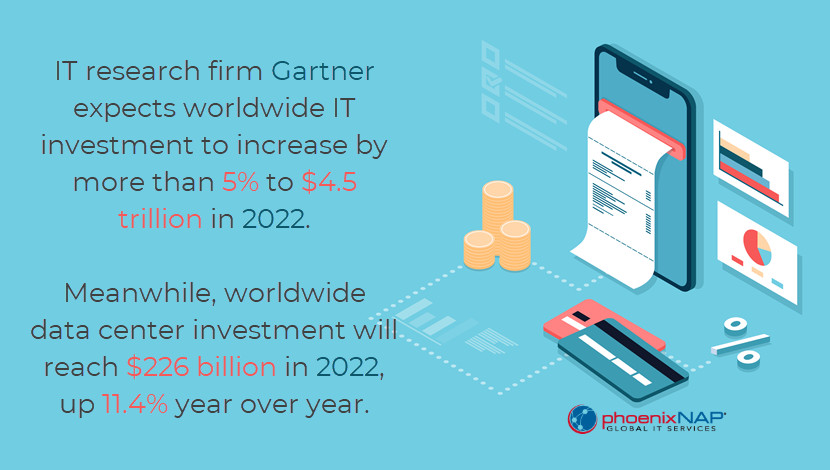

Significant Investments in the Data Center Market

Data centers offer an enticing opportunity to participate in the technology boom. Here are some of the leading investors:

- Facebook leads the pack in hyperscale development, with 19 data center campuses worldwide. Currently, the social media giant owns 40 million square feet of real estate worth more than $20 billion.

- JPMorgan Chase, the world’s largest financial services company, spent $2 billion building new data centers in 2021. Additionally, they recently announced plans to invest even more.

- Microsoft, Amazon, and Google continue to be significant drivers of growth in the data center market. As of 2022, they collectively account for over half of all major data centers.

7 Future Trends That Will Affect the Data Center Industry

In the years to come, seven dominant trends will shape the data center market:

1. Climate Change Will Shape Site Selection

The mantra of “location, location, location” is more critical than ever as climate change alters the status quo. Investors should prioritize real estate with sufficient cooling, security, and electricity infrastructure.

Four key contributors make the Phoenix metro area stand out in the data center market.

2. Data Center as a Service

Many predict that Data Center as a Service (DCaaS) is the next logical evolutionary step from Infrastructure as a Service (IaaS). Experts expect the DCaaS market size to reach $298.5 billion by 2026, with an estimated compound annual growth rate of 12.7%.

DCaaS provides all the benefits of IaaS plus infrastructure automation support via API and CLI, cloud-native infrastructure, and a completely customizable service, including managed and security services.

Remove infrastructure constraints and increase operational efficiency while Optimizing your Total Cost of Ownership with PhoenixNAP Data Center as a Service.

3. Resiliency and Uptime Take Center Stage

The data center industry places a premium on reliability. As more businesses adopt hybrid cloud solutions, backup and recovery services become critical.

4. Supply Chain Disruptions

For the data center business, supply chain concerns are real. Industry analysts believe equipment delays and labor shortages will be a more impactful factor in 2022.

5. Blockchain and Web3 Growth

Many Web3, Blockchain, and decentralized finance apps rely on standard cloud and dedicated server infrastructure. Naturally, all investments in this space will drive significant demand for data centers.

6. More Intense AI Infrastructure

Artificial intelligence and automation could transform not only the data center market but the infrastructure of a data center itself. Data-intensive AI models will continue to require new hardware and even larger datasets.

7. Cloud-Like Bare Metal Servers

Striking a balance between performance and cost, Bare Metal Cloud Servers combine the best features of dedicated and cloud servers. The global Bare Metal Cloud market is expected to reach $16.4 billion by 2026, up from $4.5 billion in 2020.

Deploying dedicated servers should not be a time-consuming and frustrating experience. We built Bare Metal Cloud to help you deploy and manage physical servers with cloud-like ease and simplicity.

Key Takeaways

Data centers are the cornerstone of the digital world and are becoming essential in every industry. Without them, growth in other areas of information technology would be severely limited. As the volume of data produced grows, so does the need for data centers. By 2025, industry revenues will likely exceed $58 billion, providing investors with a unique opportunity for sustainable growth.