Running a company comes with various expenses, including rent, wage bills, software licensing, and the purchase of office equipment. Depending on how you pay for the assets, your company's fees can fall either in the CapEx or OpEx category. Knowing when to use what payment model is vital to sound decision-making, well-allocated budgets, and high ROIs.

This article explains the difference between capital expenditures (CapEx) and operating expenses (OpEx), two cost types separated by a sometimes very blurry line. We delve into both financial concepts in-depth, providing ample examples and explaining how switching from CapEx to OpEx can increase turnover while making a company more financially flexible.

CapEx Vs OpEx: Head-to-Head Comparison

Both CapEx and OpEx entail spending money, but the two models require you to invest in different ways:

- CapEx is an upfront fee to buy or improve a fixed asset.

- OpEx is ongoing spending necessary to keep a fixed asset running.

The table below offers a more detailed comparison of the two payment models:

| Point of comparison | CapEx | OpEx |

|---|---|---|

| Short for | Capital expenditures. | Operating expenses. |

| Purpose | Funds for acquiring or upgrading a fixed asset. | Ongoing costs of day-to-day business operations. |

| Another common name | No. | Revenue expense. |

| Payment type | Upfront lump sum (one-time purchase). | Recurring (weekly, monthly, or annually). |

| Listed as | Property or equipment. | Operating cost. |

| Expected ROI | Provides long-term value beyond the tax year in which you buy an asset (between 3 and 20 years, depending on what you buy and in what industry). | Fully "consumed" in the tax year. |

| Examples | Machinery, buildings, laptops, vehicles, patents, IT equipment. | Office rent, utilities, salaries, cloud services, repairs. |

| Tax deduction | Cannot be deducted from income for tax purposes. | Fully tax-deductible. |

| Depreciation | There is depreciation for tangible assets and amortization for intangible assets. | No depreciation. |

| Listings | Listed in the investing activities of a company and its cash flow statement. | Shown on the income statement of a company. |

| In throughput accounting | Money spent on inventory falls under CapEx. | Money spent turning inventory into throughput is OpEx. |

| Typical approval process | Slow as high-priced assets and items typically go through several layers of management. | Fast if the item is budgeted for in the operating expense budget. |

| Upfront costs | Must pay all or most money upfront. | Low or zero. |

| Typical flexibility | Has less flexibility because the asset is a fixed, long-term investment. | Provides greater flexibility, allowing you to "cut" the expense off and look for an alternative. |

What Is CapEx?

Capital expenditures (CapEx) refer to the money a business spends on purchases and upgrades of fixed assets (buildings, vehicles, IT equipment, etc.). While exact criteria vary between industries and countries, a CapEx item usually must have the following traits:

- The purchase must be a one-off fee made in advance.

- You must own the asset after the purchase.

- The asset's proper lifecycle must be longer than a single tax year.

- The item must meet the minimum asset value (rarely below $2500).

A business can finance a CapEx asset either internally (with cash or bonds) or externally (through collateral or taking on debt). You can find CapEx info in the cash flow statement section, but it is also typically possible to derive it from the income statement and balance sheets.

The main benefit of CapEx is obvious: once you purchase an item or asset, you are its sole owner. No regular payments loom over your business, and you can alter the property as you see fit. CapEx has certain drawbacks, too. Various concerns come with this expense type:

- CapEx purchases are far more expensive than what you pay for an OpEx-based acquisition.

- You must be able to assess your needs precisely to avoid making a bad investment.

- CapEx requires precise forecasting and budgeting due to the high risk of losing money.

- Maximizing your ROI may sometimes require using an asset that isn't ideal for your needs.

In general, CapEx has two forms:

- Maintenance CapEx (buying new assets to maintain, restore, or replace an existing capital asset).

- Expansion CapEx (expanding or increasing the efficiency of an existing asset to grow the business).

Our article on IT cost reductions offers advice for lowering expenses and making more room in the budget for potential CapEx purchases.

CapEx Examples

As explained, a CapEx fee is a one-time purchase or upgrade of a major asset that should provide utility for more than one tax year. Here are several examples of these items:

- A building or room for an in-house data center.

- Privately owned servers.

- IT and office equipment (PCs, laptops, cameras, workstations, monitors, TVs, etc.).

- Vehicles.

- Patents, trademarks, copyrights (so-called intangible assets).

- Factory machinery.

- A license to use a piece of software.

- Land and construction improvements.

- Colocation equipment.

- A variety of supporting items (UPSes, line printers, air conditioners for the data center, scanners, etc.).

PhoeinxNAP's colocation services enable you to lower your CapEx by not having to invest heavily in an on-prem data center. Instead, you can set up your IT equipment at our facility in Arizona and enjoy top-tier connectivity, security, and various managed services.

What Is OpEx?

Operating expenses (OpEx) are the funds a business allocates recurrently to support day-to-day operations. Companies generally use OpEx items on a short-term basis and consume the asset within the year of the purchase.

In general, there are two types of OpEx:

- Mandatory OpEx (electricity bills, employee wages, office supplies, etc.).

- Optional OpEx (items and services that can also function as a CapEx purchase, such as choosing cloud hosting over an on-prem data center).

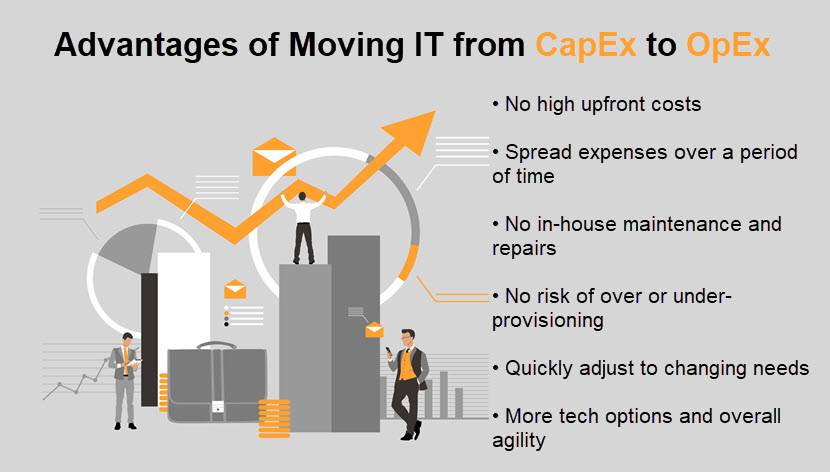

When you decide to rely on OpEx for an item that can work on a CapEx level, the drawback is obvious: you keep paying for an asset that never belongs to you. However, there are also benefits to choosing OpEx over CapEx. In the IT sector, these advantages include:

- No upfront costs. By shifting towards an as-a-service option (IaaS, PaaS, SaaS, AIaaS, IT-as-a-service, etc.), companies can reduce costs by avoiding the expenses associated with expensive software licenses or hardware.

- Less red tape. With less financial risk, budget approvals for OpEx fees are typically faster than those for CapEx.

- No long-term commitment. If an OpEx asset turns out to be a poor fit or becomes unnecessary, you can stop paying for the item or service.

- Flexibility. If a better option becomes available, changing an OpEx provider is typically quick, simple, and comes with no monetary losses.

- Scalability (up and down). Most IT OpEx-based services are scalable, ensuring you never have too many or too few resources to meet your current needs.

- More transparent ROI. Tracking ROI is easier on a monthly payment plan than on a lump-sum purchase.

PhoenixNAP's Bare Metal Cloud is the ultimate OpEx hosting option—not only do you eliminate the costs of owning a server, but our BMC also strips away the virtualization layer that boosts performance while lowering overall costs.

OpEx Examples

What constitutes OpEx varies between different companies and industries, but here are some typical examples of OpEx-based assets and costs:

- Office rent.

- Salaries.

- Insurance costs.

- Utilities (water, power, telephone bills, travel expenses, etc.).

- Equipment repair costs (unless the work prolongs the useful life of the asset, then the charge falls under CapEx).

- Attorney and legal fees.

- IT infrastructure hosted by a third-party cloud provider.

- License fees.

- Marketing fees.

- Cloud computing fees.

- Office supplies.

- Costs of raw materials and supplies.

- Cost of goods sold (COGS).

- Software subscriptions.

- Selling, general, and administrative expenses (SG&A).

Typically, costs of research and development (R&D) also fall under OpEx unless industry regulations specify otherwise.

How Are CapEx and OpEx Calculated?

If you have access to the cash flow statement, there is no need to calculate the CapEx. You can find CapEx fees in the investing cash flow section. Companies keep track of their CapEx as investors often view that stat when valuing a company. A healthy CapEx ratio (ratio of capital expenditure to sales revenue relative to industry peers) is a positive sign of growth.

If you do not have access to the cash flow statement, you can calculate the net capital expenditure if accountants break down depreciation on the income statement. Here is how to calculate CapEx if you only have access to the income statement:

- Find depreciation and amortization on the income statement.

- Locate the current and prior period PP&E on the balance sheet.

- Use the following formula to determine CapEx: CapEx = PP&E (current period) – PP&E (prior period) + Depreciation (current period)

This formula produces a net capital expenditure number, so dispositions of PP&E will lower the value of CapEx. You need to read the notes on the financial statement to adjust for this discrepancy.

You can calculate a company's OpEx with an even simpler formula. Here are two ways you can determine the OpEx:

- Operating Expenses = Salaries + Sales Commission + Promotional and Advertising Expenses + Rents + Utilities

- Operating Expenses = Revenue - Operating Income - Cost of Goods Sold

The first formula is a summation of various selling, general, and administrative expenses. The second formula determines OpEx by deducting operating income and COGS from revenue.

Should You Use OpEx or CapEx?

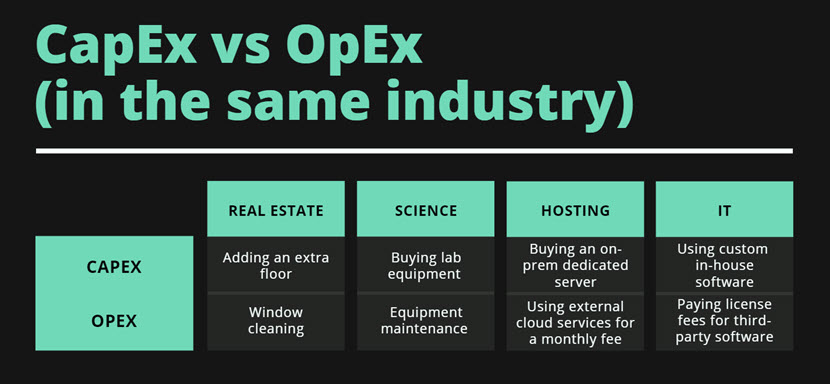

While you cannot do so for all expenses (e.g., printer cartridges will always be an OpEx), you can sometimes choose whether you want to take an expense on as CapEx or OpEx. Here are a few examples:

- Deciding whether to buy a building or rent office space.

- Deciding whether to purchase an in-house dedicated server or go with a shared hosting plan.

- Choosing whether to set up an on-prem data center or outsource a virtual data center (VDC).

- Choosing whether to invest in an edge server or rely on a third-party provider to service users in a specific geographical area.

Here are a few tips that help when deciding whether to go with CapEx or OpEx:

- Forecasting is key to both expense types. Without careful planning and budgeting, you risk overspending on CapEx or failing to estimate OpEx costs accurately.

- Always consider the non-monetary cost of an expense, such as the friction users feel when switching to a new platform.

- Compliance is a massive factor, as some regulations require you to own and keep systems on-prem. In that case, CapEx is the only choice.

- CapEx is a much bigger commitment, as you can usually cut OpEx costs with minimal financial impact.

- Purchasing assets gives you greater control, enabling customization that is not always available with OpEx.

- CapEx makes it challenging to keep up with tech advances, as purchasing the latest assets often conflicts with maximizing the ROI of your current investment.

Interested in more control over your cloud expenses? Cloud cost management tools help optimize costs and eliminate needless overhead on your cloud bill.

CapEx vs. OpEx: Always Consider Both to Ensure Efficient Use of Capital

A solid understanding of what sets CapEx and OpEx apart gives a valuable perspective during decision-making. Remember that you always have two options when investing in your business, so always consider whether an item, service, or asset would work better as CapEx or OpEx before taking out the checkbook.